Time to walk away from the slot machine – the EU’s changing perspective on airline merger remedies

A wave of mergers has commenced on the European airline market, kicked off by the acquisitions of ITA by Lufthansa Group and of Air Europa by IAG. Other mergers will also have an impact on routes between Europe and far-flung destinations (see Korean Air’s acquisition of Asiana). Looking forward, major carriers like TAP Air Portugal and SAS are likely to be acquired by large airline groups.

The EU Merger Regulation provides the basic rules under which concentrations are reviewed by the European Commission. Mergers which would significantly impede competition on the single market, notably by creating or strengthening a dominant market position, can be prohibited. Merging parties can also propose remedies to the Commission to alleviate concerns around anti-competitive effects.

When looking at a merger, the Commission first determines the relevant market (geography and product). In aviation, enforcers often take the perspective of consumers booking their travel: they analyze the competition on a particular route (a so-called Origin & Destination) between two cities. The logic is simple: the vast majority of air passengers want to go from one particular location to another one. Only flights between those locations are substitutable services and thus in direct competition.

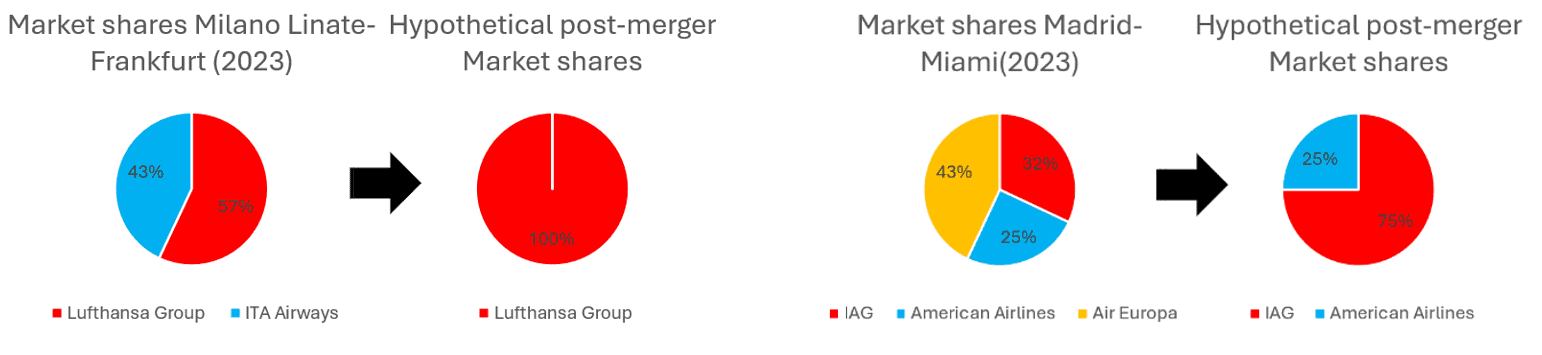

The LHG-ITA and IAG-Air Europa transactions offer good examples of routes where competition would be significantly reduced (or even eliminated) post-merger:

For consumers flying on those routes, less competition between airlines means higher prices, reduced connectivity, and a decreased quality of services, as seen in highly consolidated airline markets such as the US , where their negative effects have prompted a rethink.*1 As put by former White House Competition Policy Advisor Tim Wu: “If there’s one lesson we’ve learned from the recent history of the airline industry, it’s this: The bigger airlines get, the worse they become. The prices get higher, the seats smaller, the service ever snarkier”.

Slot remedies

Rather than prohibiting mergers, the Commission can look for remedies by the parties to address the transactions’ anti-competitive effects. In past airline mergers, remedies have been varied, ranging from structural (asset sales) to behavioral (code-sharing agreements, non-discriminatory distribution commitments). However, slot remedies are by far the most frequently used tool: the airlines relinquish their rights to either take-off or land at a particular airport at a specific time (i.e. airport slots). Relinquished slots can then be acquired by competing airlines. Slots at congested airports are highly valuable assets for airlines, with some slot sales ranking in the tens of millions.

Despite the widespread use of these commitments, there is a catch: in the words of COMP Director-General Guersent “slot remedies do not work”. (Then) Competition Commissioner Reynders recently echoed this view, stating that “maybe the results are not there”. Indeed, slot remedies are ineffective if competing airlines do not pick up divested slots. Unfortunately, past airline mergers cleared by the Commission based on slot remedies show it clearly:

- In 2004, Air France and KLM offered to make slots available for 9 intra-EU routes.*2 Only 3 of these routes were successfully taken up by competitors. Air France-KLM now operates as a monopoly on all others.

- In 2005, Lufthansa Group and Swiss Airlines offered to make slots available for 11 intra-European routes*3. On 7 of them, Lufthansa Group now operates as a monopolist. On 12 February 2024, nearly 20 years after the merger was approved, the monitoring trustee for the Lufthansa/Swiss slot commitments found out that slots have still not been taken up on any of these 11 intra-European routes.

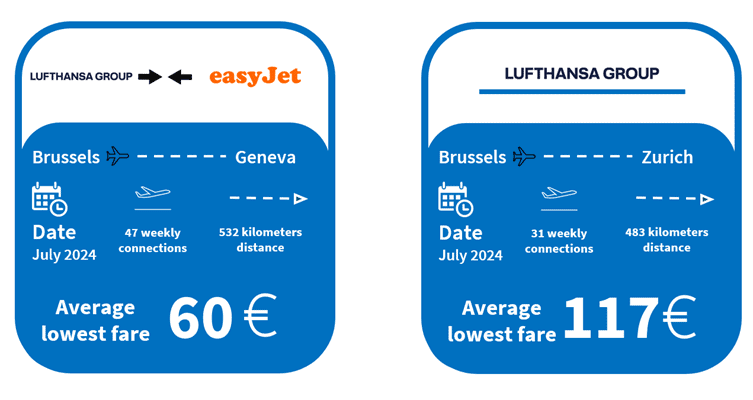

The direct price effect of these failed remedies is stark: on the Brussels-Zurich route where Lufthansa Group operates alone after its merger with Swiss, the average lowest fare is ca. EUR 117; on the Brussels-Geneva route where Lufthansa Group competes with at least one other airline, the average lowest fare is ca. EUR 60.*4 That makes the competitive route between two very similar origin-destination pairs 49% cheaper for travelers.

Looking ahead

A new approach is needed; Change has already commenced. The recent clearance decision of the Korean Air-Asiana merger shows one possibility: additional structural remedies. On top of offering slots, they have committed to sell aircraft and fully divest from Asiana’s cargo business. However, it is doubtful that a cargo divestment would have a significant impact on competition on the air passenger transport market.

These structural remedies are useful to remove barriers to entry on the supply side of the market, but they do little to ensure that smaller carriers can benefit from significant consumer visibility when competing against dominant post-merger airlines. The Commission itself foresees that access remedies such as slot divestiture are often only effective when combined with other access remedies.*5 Thus it has pushed for behavioral remedies in past merger cases to ensure that consumers can conveniently choose the services of smaller competing airlines. Examples of such behavioral remedies include code-share agreements and the opening of loyalty schemes.

Going one step further, the Commission could seek additional distribution-related remedies: indirect distribution channels shall be provided with non-discriminatory access to the merging airlines’ “content”. This would facilitate competition by providing consumers tools to compare offers of merging airlines with those of competitors, giving smaller carriers opportunities to attract consumers and thus lowering barriers to entry. When combined, distribution and slot remedies may thus provide a solution that is greater than the sum of its parts, by directly addressing the weaknesses of each remedy.

EU competition enforcers have much to consider when analyzing the plethora of current airline mergers. While these cases will be examined under immense political pressure and will bring significant complexity, it will be crucial for the Commission to ensure that competition among airlines remains vibrant, thanks to easy and transparent comparison and booking of offers.

*1 See recent decision to block JetBlue-Spirit merger.

*2 Amsterdam-Paris (CDG), Amsterdam-Lyon, Amsterdam-Marseille, Amsterdam-Toulouse, Amsterdam-Bordeaux, Amsterdam-Venice, Amsterdam-Bologna, Amsterdam-Milan, Amsterdam-Rome

*3 Zurich-Frankfurt, Zurich-Munich, Zurich-Copenhagen, Zurich-Stockholm, Zurich-Warsaw, Zurich-Burcharest, Zurich-Berlin (TXL), Zurich-Düsseldorf, Zurich-Hamburg, Zurich-Vienna, Zurich-Hanover

*4 See para. 63 of the notice on merger remedies

*5 Data for direct connections in July 2024, accessed on 15 February 2024.